Our Processes

The Processes section provides essential information on UC Riverside’s financial policies, budgetary workflows, and administrative procedures. This resource is designed to guide campus units through key financial processes, ensuring compliance, transparency, and efficiency in managing university funds.

-

Capital Finance

Capital Finance & Debt Affordability

Strategic Capital Planning & Financial Oversight

Financial Planning & Analysis (FP&A) plays a crucial role in assessing capital affordability and determining the most appropriate funding sources for campus infrastructure projects. Through integrated planning, FP&A collaborates with stakeholders to guide financial decision-making for projects outlined in UC Riverside’s 10-Year Capital Financial Plan (CFP).

Key Responsibilities

-

Debt Affordability & Financial Feasibility

- Maintain and update the Debt Affordability Model (DAM) to assess whether the campus can support additional debt while remaining within UC Office of the President (UCOP) thresholds.

- Provide financial feasibility metrics to UCOP, ensuring the university’s ability to sustain debt service payments on externally financed projects.

-

Executive Leadership Advisory

- Deliver financial analysis and insights to senior leadership on key capital project decisions.

- Evaluate auxiliary business plans, pro forma models, and capital project feasibility to assess financial viability and long-term sustainability.

-

Stakeholder & Policy Compliance

- Ensure that capital project stakeholders adhere to campus, state, federal, and private funding policieswhen utilizing financial resources.

- Provide guidance on funding sources, including general funds, contracts & grants, endowments, and restricted funds.

-

Capital Improvement Budget & Funding Execution

- Facilitate the sequestration of approved funds by coordinating funding instructions with Accounting.

- When the project is over, we work with accounting to return funding to the original source.

Debt Affordability Model (DAM) & Capital Funding Sources

To secure external financing for capital projects, UCOP requires each UC campus to demonstrate adequate debt capacitythrough the Debt Affordability Model (DAM). This model provides 10-year projections of financing benchmarks, including key debt ratios that determine financial feasibility.

Common funding sources for capital projects include:

- General Revenue Bonds (GRB)

- General Obligation Bonds (GOB)

- State Public Works Bonds (SPWB)

- Century Bonds (CB)

- Lease Project Revenue Bonds (LPRB)

- Assembly Bill (e.g., AB94) Financing

Debt Model Access & Structure

The Debt Model is maintained in a UCOP dropbox but managed by FP&A and includes multiple data input tabs that roll up into a Debt Ratios dashboard, aligning with UCOP-approved financial thresholds. These projections ensure that UC Riverside remains financially sustainable while making strategic capital investments.

-

-

CBR & Cost Recovery

Composite Benefit Rates (CBRs)

In alignment with UCPath’s goals of standardizing processes and increasing efficiency, UC Riverside has established Composite Benefit Rates (CBRs). These rates are calculated as a percentage of an employee’s salary, categorized by Employee Groups, and remain consistent regardless of individual benefit selections.

CBRs simplify budgeting and financial planning by ensuring predictable benefit costs across campus units. FP&A manages the CBR proposal with the Office of the President and the Cognizant Federal Agency DHHS.

- View Current CBR Rates: here.

Annual CBR Mitigation Process

CBR mitigation is a process managed by the Central Budget Office (CBO) to ensure each organization (Org) has the right amount of permanent benefits budget to support filled positions paid from core funds—specifically, 19900, 19912, 19924, 19942, and 67000.

These benefits budgets are pooled together into what’s called the Benefits Pool, which includes all permanent budget in benefit categories BC20 and BC30 within core funds. It doesn’t matter what other COA elements are tied to the budget (like activity or function)—if it’s in BC20 or BC30 and from one of those core funds, it’s part of the pool. BC76 can no longer be used for permanent budget but can still be used for cash management of temporary savings or unallocated benefits.

Each year, the CBO takes a snapshot of core-funded positions as of the last working day in December. This timing captures salary changes that usually happen on July 1 and October 1. That snapshot becomes the basis for estimating how much permanent benefits budget each Org will need for the next year. After the snapshot is reviewed and updated by the units, CBO applies the upcoming fiscal year’s CBR rates and either allocates additional funds or pulls funds back from the Org’s Benefits Pool to align the budget accordingly.

A few important reminders for units:

- Don’t move permanent benefit funds out of the pool—they’re not discretionary and must stay in BC20 or BC30. You can move them between activities, but only within those benefit categories.

- The only exceptions are re-orgs where entire activities or departments shift Orgs, or in the case of budget cuts managed by FP&A.

- If you're funding a salary action (like a promotion or reclass) that isn’t centrally funded, you need to permanently allocate both salary and benefit funds yourself. The CBO will pick up future increases once the position is fully budgeted.

- If a position is filled or vacated right after the snapshot, don’t change the permanent budget for benefits. The Org should manage the cash impact locally. The change will be picked up in the following year’s snapshot.

- To help track these actions, the “Perm Benefit Transfers” report in Oracle Budget shows all permanent budget entries into BC20 and BC30 for the five core funds. It includes sources like July 1 perm budgets, intra-org adjustments, budget model transfers, and more.

As part of reconciliation, which will begin in January 2025 using the December 2024 snapshot, units will need to match up what’s in the Oracle report with the reconciliation template. Since Oracle Budget isn’t transactional, it’s strongly recommended that units keep a running copy of their reconciliation template throughout the year to note any permanent changes they’ve made

CBR Training

Fund 69993 Cost Recovery – Updated Guidance

Effective January 1, units should use the Fund 69993 Cost Recovery Clearing Form to identify expenses that have posted to the suspense fund for the applicable earn code types listed below. These expenses must be moved to the appropriate fund and reimbursed.

Reimbursable earn codes include:

- PFCB: PFL, PFN, PB7, PB8, PB9, PF7, PF8, PF9, 9PB

- PCC: PCC, P18, P19

- STAR awards: XSC

Please note the following requirements: - An SCT must be submitted to move all original charges to the appropriate fund before a cost recovery request is submitted.

- Corrections must be submitted within 90 days of the original Fund 69993 posting date.

- The reimbursement template is available on the FP&A website. Our office will work with units on applicable costs dating back to July 1, 2025. Charges prior to FY26, when our office began managing this process, will not be revisited.

- If you have questions regarding this process, please contact our team.

-

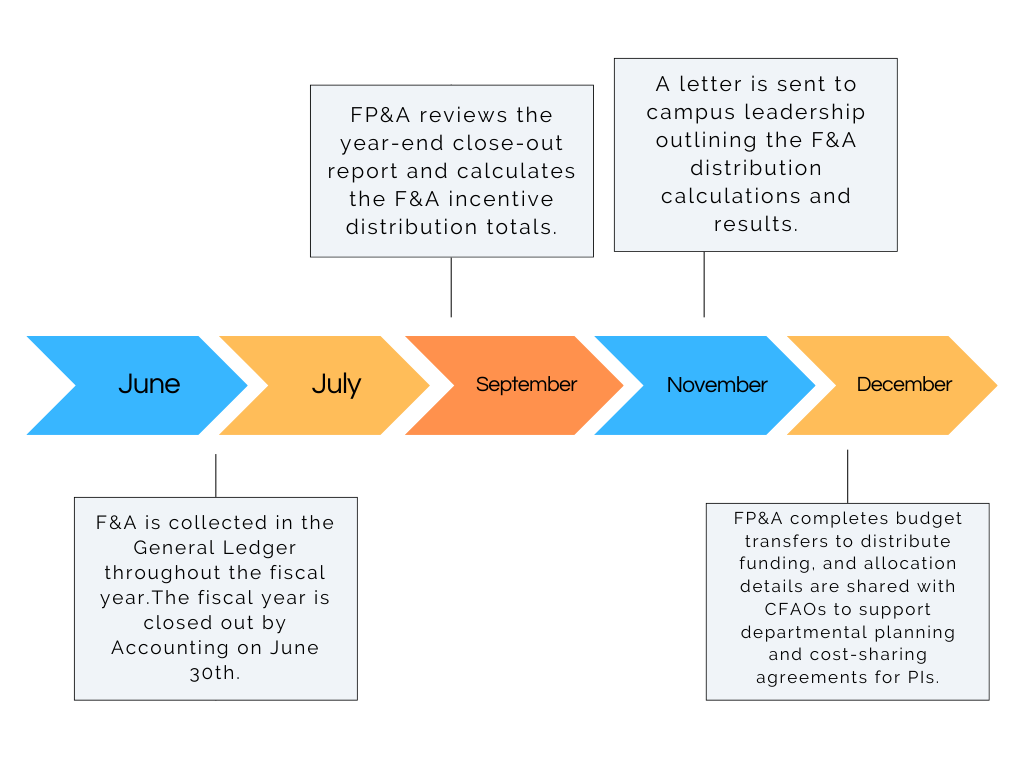

Facilities & Administrative Cost Recovery

The Facilities and Administrative (F&A) reimbursement is derived from Federal, State, Local, and Private contracts and grants and specific UCOP Funds. UCR uses the F&A reimbursement to calculate an incentive to grow the research enterprise. The incentive distribution was most recently updated in FY22 and provides funding in core funds as follows:

-

5% to the Principal Investigators (PIs) in one-time funding

-

10% to the Departments in one-time funding

-

14% to Central Resources in one-time funding

-

20% to Research and Economic Development (RED) in core permanent funding

-

25% to Schools/Colleges/RED in core permanent funding (all others in one-time funding)

-

26% as a redirect from Central Resources to Schools and Colleges for research related

expenses as core permanent funding

Review the following documents for more information:

-

-

Rate Development

Rate Development

Understanding the various rates and assessments is crucial for effective financial planning and compliance. Below is an overview of key components, each accompanied by a brief description and a link to the relevant UCR Accounting resource.

1. Composite Benefit Rate (CBR)

The Composite Benefit Rate simplifies budgeting by consolidating various employee benefit costs into a single rate. This approach streamlines the allocation of benefit expenses across departments and helps to prevent discrimination in department hiring practices.

Resource: Composite Benefit Rate Overview

2. Facilities & Administrative (F&A) Rates

Facilities & Administrative Rates, also known as indirect cost rates, recover expenses associated with institutional overhead, such as facilities maintenance and administrative services, derived from sponsored projects. FP&A works with UCOP and the F&A rate proposal.

Resource: F&A Rates Information

3. General Liability, Auto, and Employment Practices Insurance (GLAEP)

GLAEP rates are calculated to distribute the cost of insurance premiums required by the office of the president. The rates are applied as a payroll assessment.

Resource: GLAEP Details

4. Administrative Cost Recovery

This process involves recouping costs incurred by central administrative units in support of self-supporting activities.

Resource: Administrative Cost Recovery Policy

5. UCOP Funding Assessment

The UC Office of the President (UCOP) Funding Assessment is a levy on campus revenues to fund systemwide initiatives and the administrative functions of UCOP. UCR distributes the cost of the assessment based on prior year expenses to all funding sources. The current UCOP Funding Assessment rate is 2.5%.

Resource: UCOP Funding Assessment Overview

6. Unemployment Insurance

The Unemployment Insurance rate is the rate calculated to cover our premium to the office of the president. The rates are applied as a payroll assessment and is part of the overall CBR rate.

Resource: Unemployment Insurance Information

7. Workers' Compensation

Workers' Compensation provides benefits to employees who suffer work-related injuries or illnesses, covering medical expenses and wage replacement. The Worker's Compensation rate is calculated to cover our premium to the office of the president. The rates are applied as a payroll assessment and is part of the overall CBR rate.

Resource: Workers' Compensation Program

8. Vacation Accrual

Vacation Accrual policies dictate how employees accumulate paid vacation time, impacting financial liabilities and staffing considerations.

Resource: Vacation Accrual Guidelines

For comprehensive information on these topics, please refer to the UCR Accounting Services website.

Note: The links provided above are based on standard university accounting structures and may need to be updated with specific UCR resources.

-

Fixed Cost Increases

Fixed Cost Increases

Effective financial planning requires a comprehensive understanding of fixed cost increases—expenses that are largely predictable and recur annually. Below is an overview of key fixed cost components, each accompanied by a brief description and a link to the relevant UC Riverside (UCR) resource.

1. Salary and Benefit Increases

Annual adjustments to faculty and staff salaries, along with associated benefits, permanently budgeted on core funds are provided through Subvention allocations. For Fiscal Year 2025 (FY25), UCR is committed to a 4.2% salary and benefit increase for faculty and non-represented staff, in addition to planned increases for represented staff as per their negotiated contracts. These adjustments amount to over $28 million in new core expenses.

Resource: FY25 Budget Planning Announcement

2. Utilities and Facility Operations (OMP)

OMP is two-fold with increases in costs for utilities from external providers and initial funding for new buildings coming online requiring infrastructure and services. Regular maintenance of existing facilities, including custodial services, landscaping, and repairs, constitutes a predictable fixed cost necessary for campus functionality and safety.

3. Debt Service Obligations

Debt service payments for previously financed capital projects are fixed commitments that the university must meet annually. These obligations are factored into the overall budget to ensure financial stability.

Understanding these fixed cost components is essential for effective budgeting and financial planning at UCR. For more detailed information, please refer to the linked resources or contact the respective administrative offices.

-

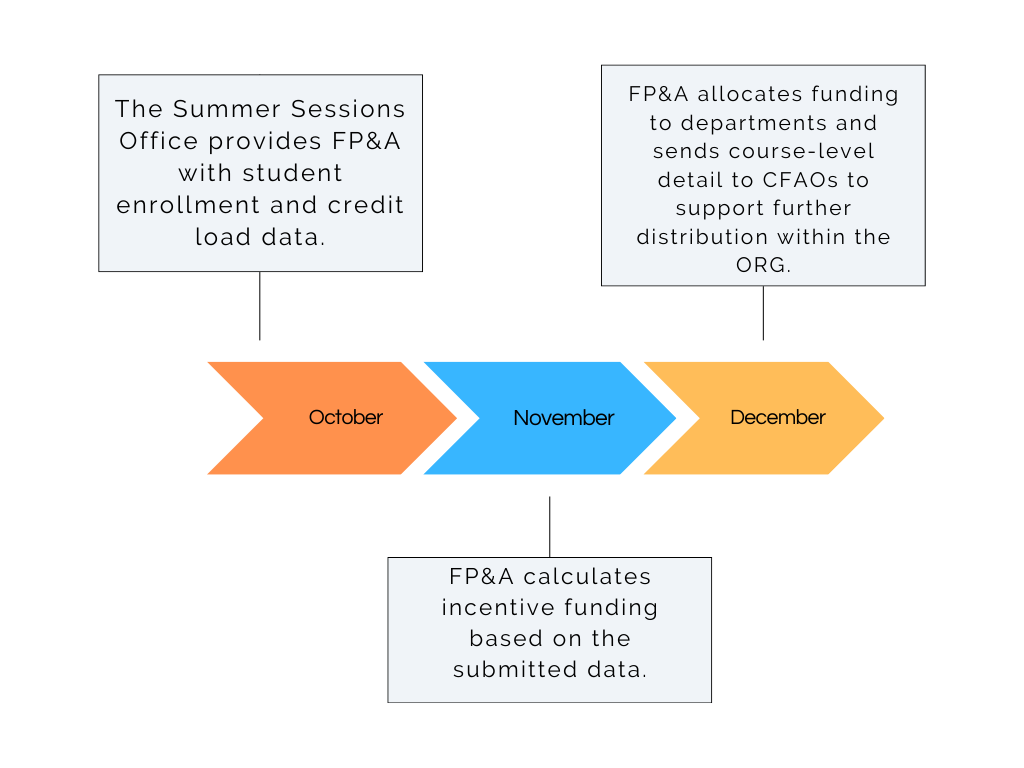

Summer Session

Incentivizing Summer Teaching: Summer Session & Budget Impact

Under UCR’s budget model, Summer Session operates as a self-supporting program, with tuition revenue flowing back to the participating departments. Encouraging faculty to teach in the summer benefits both academic units and instructors, as:

- Departments receive a portion of summer tuition revenue, helping offset annual fixed costs.

- Faculty earn additional compensation while providing students with more flexible course options.

- Summer enrollments improve time-to-degree for students, reducing bottlenecks in high-demand courses.

By incorporating Summer Session into financial planning, academic units can increase discretionary revenue, supporting faculty and programmatic needs while enhancing student success.

Resource: Summer Sessions Information

-

Student Fees

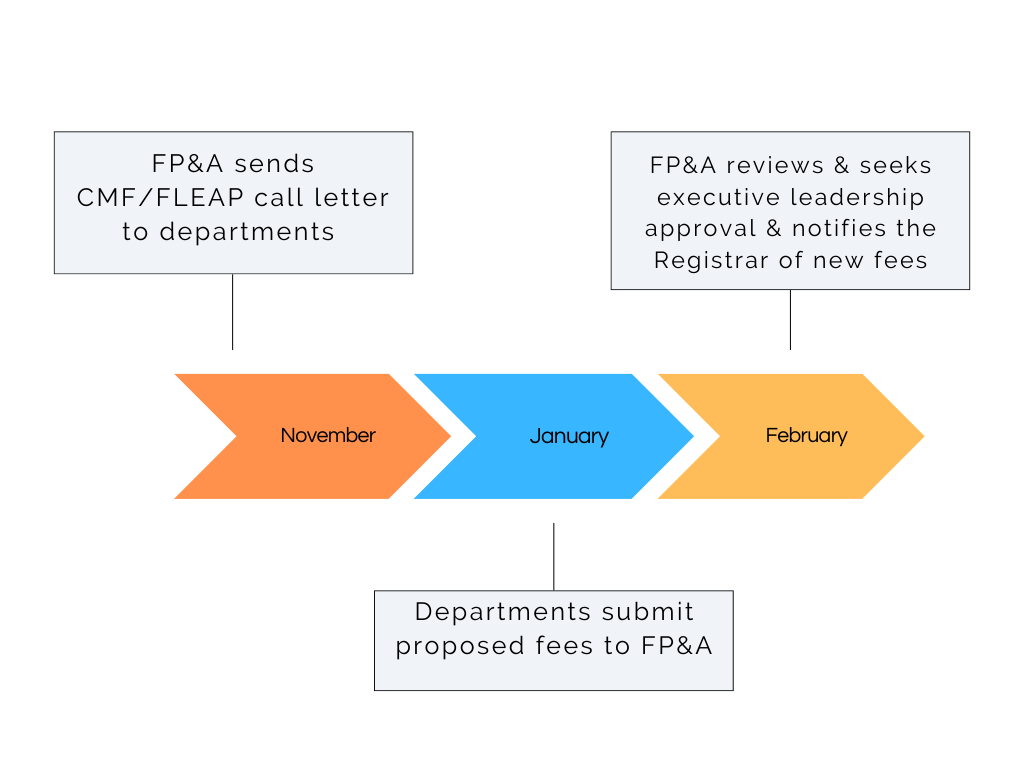

1. Course Materials and Service Fees (Incl. FLEAP)

Description: These fees are course-specific and cover the cost of materials, supplies, university-owned equipment, and educationally beneficial services. They are noted in the class listings and assessed upon student registration. FLEAP fees are the course material fees associated with summer abroad programs.

Please note: A UCR student should not be directed to pay a 3rd party vendor for digital access/content integrated with Canvas. The expense needs to be paid by the department as an instructional delivery cost and can only be passed to the student through an approved Course Material Fee. Please have your FAO/FOM work with FP&A for new CMFs or changes to existing CMFs.

Submission Timeline:

- November: Call letter goes out to departments.

- January: Departments submit proposed course material fees for the upcoming academic year.

- February: Fees are finalized and approved.

Relevant Policies:

- CMF/FLEAP Form: New CMF & FLEAP Form

- UCR Policy: Course Materials & Services Fees

- UCOP Policy: Course Materials and Services Fees Policy

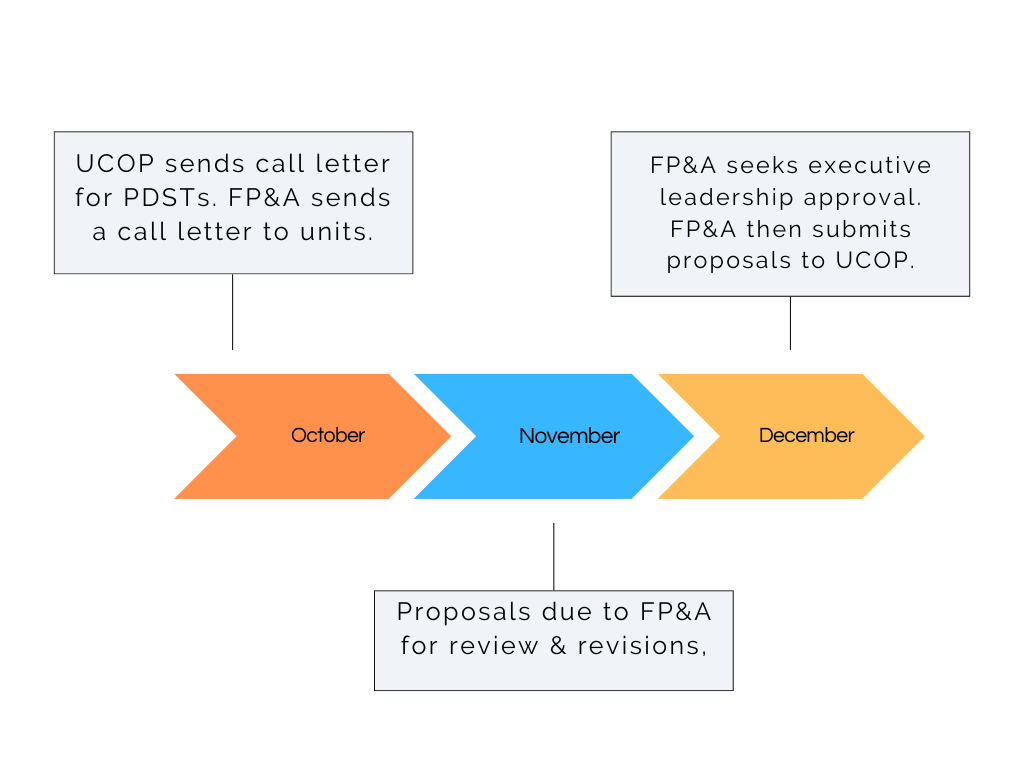

2. Professional Degree Supplemental Tuition (PDST)

Description: PDST is an additional tuition charged to students enrolled in designated professional degree programs to support program costs and enhancements.

Submission Timeline:

- October: UC Office of the President (UCOP) issues the call for PDST proposals. FP&A sends this out to units.

- November: Proposals are due to FP&A for review.

- December: Proposals are due to UCOP.

- Frequency: PDST proposals are submitted every 3-5 years, depending on the program's review cycle.

Relevant Policies:

- UCR Guidelines: Coming Soon

- UCOP Policy: Professional Degree Supplemental Tuition Policy

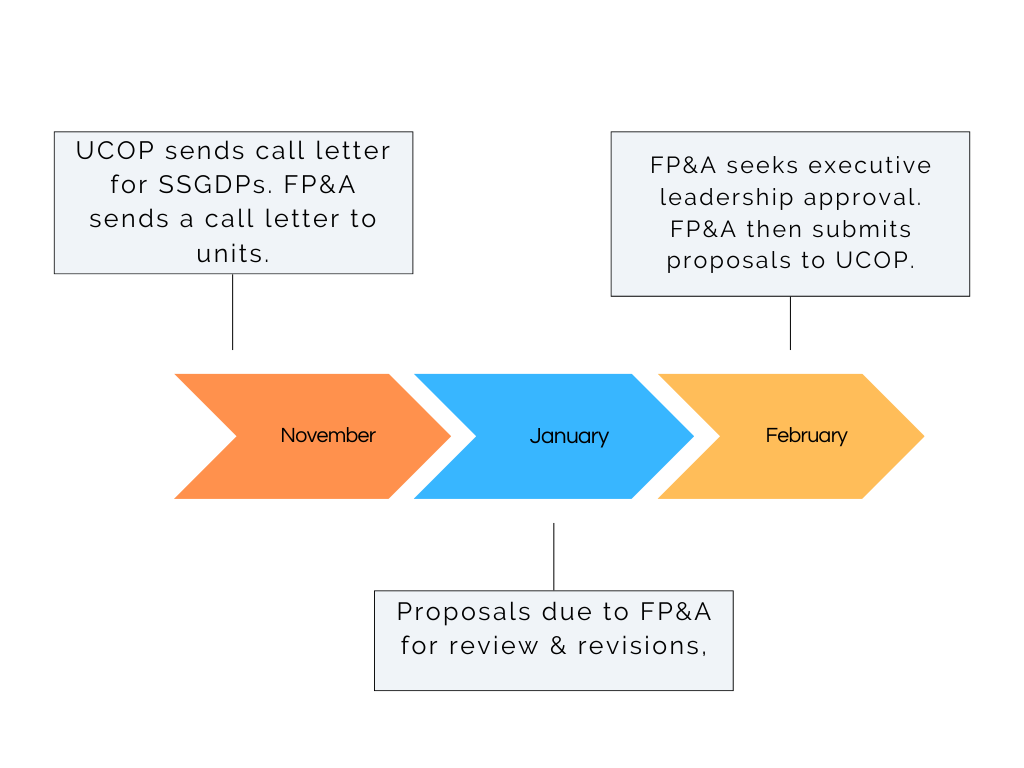

3. Self-Supporting Graduate Professional Degree Programs (SSGPDP) Fees

Description: These fees apply to programs that do not receive state funding and are designed to be fully self-supporting, covering all program-related costs through student charges.

Submission Timeline:

- November: UCOP issues the call for SSGPDP fee proposals.

- January: Proposals are due to FP&A for review.

- February: Proposals are due to UCOP.

- Frequency: Annually.

Relevant Policies:

- UCR Guidelines: UCR SSGPDP Guidelines

- UCOP Policy: Self-Supporting Graduate Professional Degree Programs Policy

4. Miscellaneous Fees

Description: These include various other fees such as application fees, late registration fees, and document fees.

Relevant Policies:

- UCR Guidance: Miscellaneous Fees

- UCOP Policy: Miscellaneous Fees Policy

Registrar's Office

For comprehensive information on all student fees, submission deadlines, policies, and necessary forms, please visit the UC Riverside Registrar's Office.

Note: All deadlines and procedures are subject to change. It is recommended to consult the Registrar's Office or the respective administrative department for the most current information.

Comparison of Student Fees at UC Riverside

Fee Type Description Submission Timeline Frequency Course Materials & Service Fees (CMF) & FLEAP Fees Fees for course-specific materials, supplies, equipment, and educational services. FLEAP fees apply to summer abroad programs. November:Call letter sent to departments.

January:Departments submit proposed fees.

February: Fees finalized and approved.Annually Professional Degree Supplemental Tuition (PDST) Additional tuition for professional degree programs to support program costs and enhancements. October:UCOP issues call for PDST proposals.

November:Proposals due to FP&A for review.

December:Proposals due to UCOP.Every 3-5 years Self-Supporting Graduate Professional Degree Programs (SSGPDP) Fees Fees for programs that do not receive state funding and are designed to be fully self-supporting. November:UCOP issues call for proposals.

January:Proposals due to FP&A.

February:Proposals due to UCOP.Annually Miscellaneous Fees Various other fees, including application fees, late registration fees, and document fees. N/A As needed -

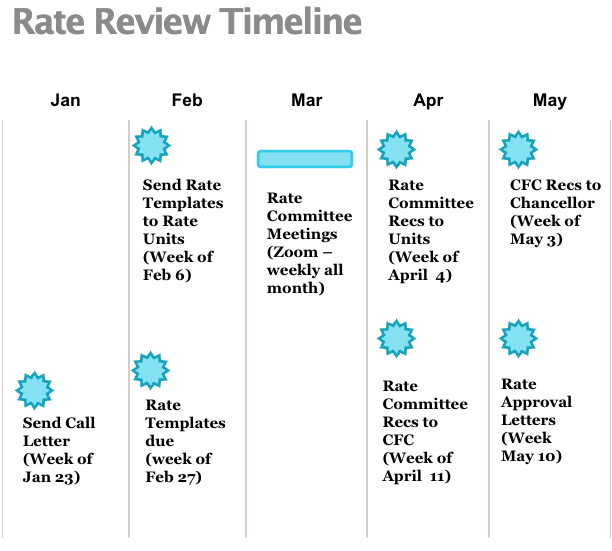

Rate Review Process

Rate Review Process Overview

The Rate Review Policy outlines the criteria, process, and timeline for reviewing rates within recharge units and auxiliary enterprises at UC Riverside. This process ensures financial viability, appropriate fund balances, rate approvals, and compliance with university policies.

Rate Review Committee & Approval Process

Committee Charge

The Rate Review Committee (RRC) evaluates the financial operations, reserves, and proposed rates for recharge units and auxiliary enterprises. The committee's recommendations are submitted to the Vice Chancellor for Planning, Budget, and Administration (VCPBA) for approval by the Provost. The Campus Finance Committee (CFC) are notified of rate approvals and have the opportunity to give feedback.

Committee Membership

The Rate Review Committee consists of:

- Associate Vice Chancellor for Financial Planning and Analysis

- Associate Vice Chancellor for Business and Financial Services

- Director of Internal Audit

- Staff support provided by the Office of Financial Planning and Analysis (FP&A)

Rate Review Criteria

A campus unit will be subject to rate review if it meets one or more of the following criteria:

✔ Campus-Wide Service Provider – Serves the entire university community.

✔ Significant Financial Activity – Annual income exceeding $500,000.

✔ Campus-Wide Financial Impact – Affects overall university budget and funding models.

✔ Risk Exposure – Poses financial, compliance, or operational risks.

✔ Deficit Balance Review - Review Sales & Service funds in deficit across the entire campus. Require deficit recovery plans as needed.Units meeting these criteria undergo a formal annual review by the Rate Review Committee, with final oversight by the Vice Chancellor for Planning, Budget, and Administration (VCPBA).

This process ensures that rates remain cost-effective, equitable, and aligned with university policies.

📌 Relevant Policies & Resources:

-

Sales & Service Activities

Sales & Service Policies at UC Riverside

UC Riverside has two distinct policies governing Sales and Service Activities:

- General Sales & Service Activities Policy – Covers standard campus business enterprises that provide goods and services on a cost-recovery basis.

- Organizational Sales and Services Fund (OSSF) Policy – Governs low-dollar value or one-time activities, which require simplified financial oversight.

Both policies ensure financial compliance, cost recovery, and alignment with University of California (UC) policies and federal guidelines regarding external sales and university resources.

1. Sales & Service Activities Policy

The Sales and Service Activities Policy applies to revenue-generating operations that provide goods and services to internal campus units and external customers. These activities must align with university policies to ensure transparency, financial sustainability, and compliance with UC system-wide regulations.

Key Financial Guidelines

✔ Full Cost Recovery – Activities must recover both direct and indirect costs.

✔ Allowable Costs – Expenses directly related to providing goods/services.

✔ Unallowable Costs – Personal expenses, fines, entertainment, etc.

✔ Surpluses & Deficits – Must be monitored; significant imbalances require corrective action.

✔ Inventory Management – Units must avoid excessive stockpiling or unsustainable purchasing.📌 Policy Link: UCR Sales & Service Activities Policy

Process for Establishing a Sales and Service Activity:

Proposal Submission

- Departments must prepare a detailed proposal, including:

- Description of the activity

- Budget projections (revenues, expenses)

- Pricing structure

- Identification of internal vs. external customers

- Departments must prepare a detailed proposal, including:

Departmental & FP&A Review

- Departmental Review: The proposal must be approved by the Dean or Vice Chancellor.

- Financial Planning & Analysis (FP&A) Review: FP&A evaluates compliance with financial policies and cost-recovery guidelines.

Final Approval & Implementation

- Once approved, a Sales & Service Fund is established.

- Units must adhere to approved pricing structures and financial oversight requirements.

University Policy on External Sales

Per UC policy, external sales should only occur when:

✔ The goods/services are not commercially available.

✔ The activity enhances teaching, research, or public service.

✔ It does not compete with private businesses unless explicitly justified.📌 Reference: UC Academic Personnel Manual (APM-020) – External Services Policy

Sales & Services Application Form

- Download the application form: SSA Form

- Submit via email to budgetoffice@ucr.edu, including supporting documentation.

- Review Process: Applications will be reviewed and approved by FP&A within 3-4 weeks.

📌 Policies & Forms:

2. Organizational Sales and Services Fund (OSSF) Policy

The OSSF Policy is a simplified framework for low-dollar value or one-time sales and service activities. Unlike standard Sales & Service Activities, OSSF activities have lower financial thresholds and reduced administrative requirements.

Key Differences from Standard Sales & Service Activities

Category Sales & Service Activities Organizational Sales and Services Fund (OSSF) Revenue Threshold No fixed limit (typically >$15,000) $15,000 per year (ongoing) or $100,000 (one-time) Staffing May include salary/benefits for employees No direct salary/benefit charges for permanent staff Primary Customers Internal & External Primarily External Approval Process Full FP&A review Dean/VC approval, limited FP&A oversight OSSF Approval Process

- Internal Departmental Approval – Units must seek approval from the Dean or Vice Chancellor.

- Budget Submission – A budget must be submitted, detailing revenues and expenses.

- Sales Tax Compliance – Departments must collect and report sales tax on external transactions.

- Limited FP&A Oversight – Unlike standard Sales & Service Activities, FP&A primarily monitors high-impact OSSF activities.

📌 Policy Link: UCR Organizational Sales and Services Fund Policy

-

ITFs

An Interlocation Transfer of Funds (ITF) is a budgetary transaction used within the University of California (UC) system to transfer funds between UC campuses or between a UC campus and the UC Office of the President (UCOP). This mechanism facilitates financial collaboration across the UC system, enabling academic departments, research units, and programs to allocate resources for various purposes at other UC locations.

Key Aspects of ITFs:

Purpose: ITFs are primarily utilized to support collaborative projects, research initiatives, and other inter-campus activities by reallocating funds appropriately.

Initiation: The campus sending funds typically initiates the process and is responsible for submitting the formal request in the UCOP ITF system. UCR departments must obtain Central Budget Office (CBO) approval before receiving or sending funds to another campus. To begin, departments should submit UCR’s ITF template to CBO.

Restrictions: Certain transactions, such as intercampus payroll or extramural research funds, are not processed through ITFs and require alternative procedures.

Recent Policy Update at UC Riverside (UCR):

Effective September 1, 2023, UCR implemented a new process for ITFs:

Centralization: Responsibility for ITFs has shifted from the Accounting Office to the Central Budget Office (CBO). All ITF requests, whether sending or receiving funds, must now be coordinated with the CBO.

Submission Process: Units are required to complete the ITF Template (updated Nov. 3, 2025) and submit it to the CBO via Google Forms Sheet. We will reach out to you with questions and when your form is completed.

Please note that the ITF process is closed from May 21st until July 1st of each year due to UCOP closing requirements. If you need to submit an ITF you can already do so and we will begin working on ITFs submitted on July 1st.

Deadlines: To ensure processing within a given month, the CBO must receive completed ITF templates no later than the 20th of that month.

For detailed guidance on completing ITF forms and understanding specific requirements, refer to the UCOP's Interlocation Transfer of Funds guidelines.

Please reference this detailed document on frequently asked questions regarding the ITF Process.

Email us at itf@ucr.edu for any questions about ITFs or the ITF process.

-

Faculty Recruitment & Administrator Funding

Faculty Recruitment & Administrator Funding

These are the consolidated policies impacting various aspects of a Faculty Administrators & Faculty Recruitment.

-

Staffing

The Staffing process ensures that each COA has sufficient permanent funds to cover academic and staff salaries, remain in balance with Oracle Budget, and comply with UCOP reporting standards. Staffing must be balanced quarterly, with FP&A enforcing backend adjustments if units do not meet deadlines. Data is sourced from UCPath’s BDP, Oracle Budget transfers, and the SmartView 4.50 FTE Data Entry form, and CFAOs are responsible for ensuring accuracy and corrections. Key reminders:

Staffing balance due: Sept 30, Dec 12, Mar 31, May 31, June

FTE must be to two decimals; provisions require proper labeling

Costing reports must be reviewed; core funds may be centrally provided, non-core are unit-funded

No negative permanent budgets allowed; offsets required for any changes

Please review our Staffing SOP as well as our BDP training guide for more information on Staffing.

You can also review the following training videos:

Signing into Budget Distribution Page (BDP):

2. Searching for Position Numbers

3. Adding Position Numbers to BDP

4. Termination or Vacant Position

5. Budget Distribution Navigation

6. Split Funding Someone currently in BDP

7. How to Add or Remove a Staffing Position

8. Searching for Position Details

9. How to Change an Existing Group Provision

10. Generating the Staffing Reports in Oracle Budget

11. Comparing Staffing Detail Report used for Costing Reports